Dec 4, 2025

Insights

4 min

Eterna's Insights - November 2025

To receive our Insights newsletter you can sign up here

Key Takeaways:

Coinbase Unveils New Retail Token Sale Platform

Price Action: Harsh Drawdown Despite Positive Fundamentals

BlackRock Leadership: Tokenization Will Transform Global Finance

Coinbase Revives Regulated Retail Token Launches with New Public Sale Platform

Coinbase made headlines in November with the launch of its new token-sale platform, reopening regulated retail access to early-stage token launches in the U.S. - something not seen since 2018. The first offering, Monad (MON), used an allocation model that favours smaller participants and includes structured disclosures, issuer lock-ups, and anti-flipping mechanisms. The new platform represents Coinbase’s most ambitious attempt to bring transparency, fairness, and compliance to public token launches.

The move has generated mixed but measured reactions. Some question whether a large U.S. exchange can successfully revive a format long associated with the 2017-2018 ICO frenzy, while others see Coinbase setting a new, more professional standard for early-stage distribution. Overall, sentiment leans toward cautious optimism: if executed well, this could broaden access, improve market discipline, and create a more credible path for token issuance in the U.S.

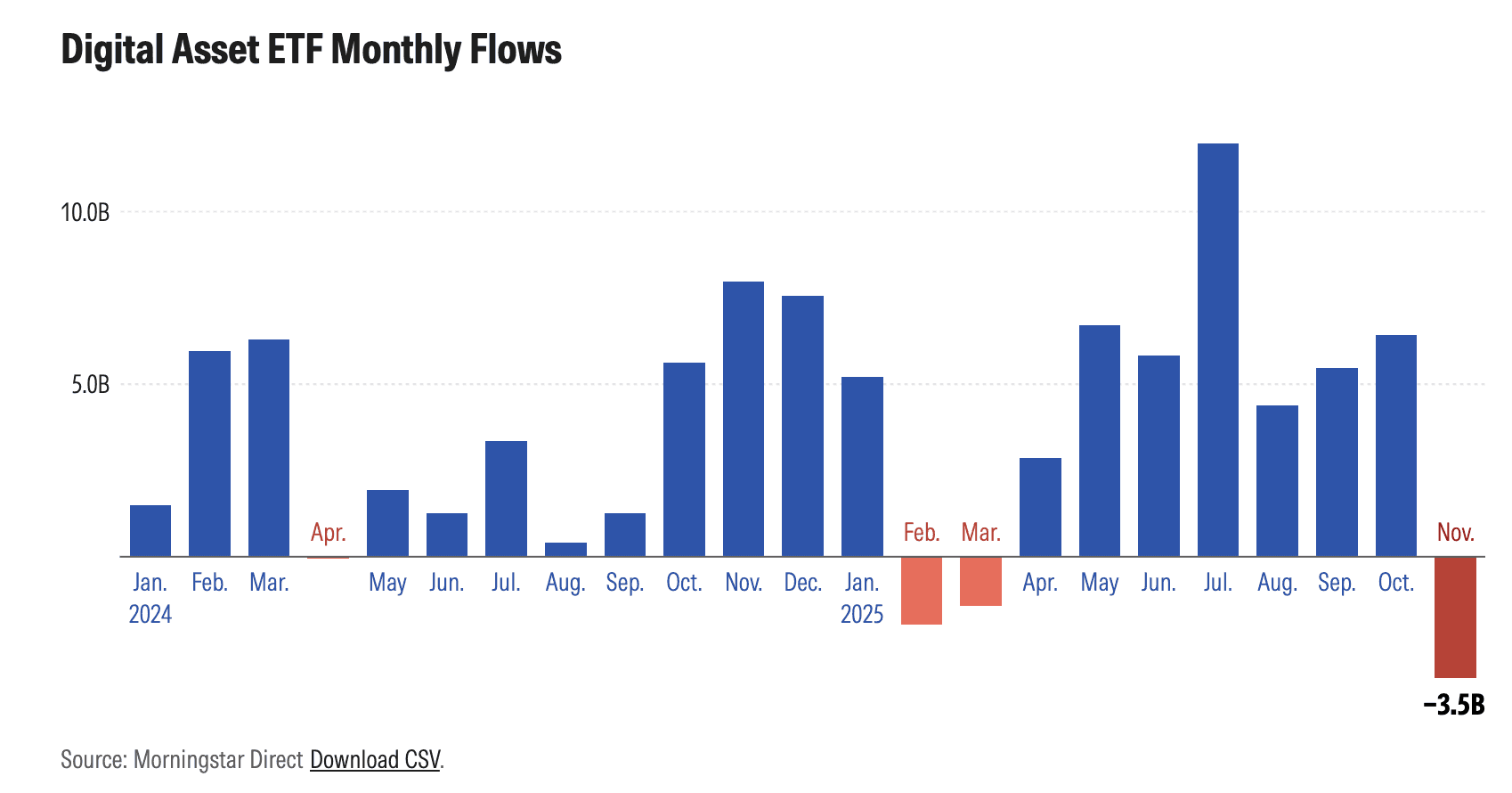

November Price Action: Harsh Drawdown Despite Positive Fundamentals

Despite strong institutional and regulatory headlines, November delivered one of the sharpest drawdowns of the year. Bitcoin experienced a c.20% price decline. This move was reinforced by heavy pressure in the ETF market, where U.S. spot Bitcoin and Ethereum ETFs saw more than US$3.4 billion in net outflows, the largest monthly exodus since February. Analysts broadly attributed the correction to macro uncertainty, profit-taking near cycle highs, and liquidity normalization.

This divergence - positive structural progress versus negative price action - highlights the increasing maturity of crypto markets. Tokenisation, stablecoins, and real-world payment integration continue to strengthen, yet short-term trading remains highly sensitive to flows, positioning, and macro catalysts. For long-term investors, November was a reminder that infrastructure advancement and market pricing often move on different timelines, especially in periods of shifting liquidity conditions.

BlackRock Leadership: Tokenization Will Transform Global Finance

In a recent piece published in The Economist, Larry Fink and Rob Goldstein argue that tokenization represents the most important upgrade to financial market infrastructure since the shift from paper certificates to electronic records. They highlight that almost any asset - equities, bonds, real estate, cash - can be issued and traded as digital tokens, enabling near-instant settlement, reduced counterparty risk, and lower operating costs. Beyond efficiency, they see tokenization as a way to broaden access to traditionally illiquid or high-barrier asset classes through fractional ownership and automated compliance.

They also emphasize that this shift requires more than technological capability: regulatory frameworks, identity standards, and interoperability with existing financial systems must evolve in parallel. Comparing the current moment to “the internet in the mid-1990s,” they caution that tokenization is still early, but its long-term impact could be profound. If regulators and institutions move together, tokenized markets could become the default infrastructure for global finance over the coming decade.

Full article here.

Klarna Announces Dollar-Backed Stablecoin “KlarnaUSD”

Fintech giant Klarna announced it will issue a U.S. dollar-backed stablecoin, “KlarnaUSD,” slated for mainnet deployment in 2026 on Tempo, the payment-focused blockchain backed by Stripe & Paradigm. The move positions Klarna as one of the largest consumer-finance brands to launch a stablecoin, aiming to integrate it across cross-border payments, checkout flows, and embedded finance rails.

This marks another major proof point that stablecoins are becoming the global payment infrastructure of the next decade. By entering the market, Klarna is effectively validating that blockchain rails offer superior economics for settlement, FX, and global commerce. Expect more fintechs and neobanks to follow suit as stablecoins become a default layer for digital payments.

Switzerland and Canada Move Toward Institutional-Grade Stablecoin Regulation

November saw two major jurisdictions - Switzerland and Canada - take decisive steps toward formalizing stablecoin regulation. Switzerland launched a comprehensive consultation to introduce new licences for “crypto institutions” and “payment-instrument institutions,” with dedicated frameworks for issuing and supervising stablecoins under FINMA. The proposal positions Switzerland to become one of the first countries with a fully bespoke regulatory perimeter for institutional-grade stablecoin issuance, aligning it with its long-standing reputation as a global financial and digital-asset hub.

Canada followed with its 2025 Federal Budget, which for the first time outlined a full legislative regime for fiat-backed stablecoins. The framework brings stablecoin issuers under the oversight of the Bank of Canada and integrates them into the Retail Payments Activities Act, creating clear rules around reserves, disclosures, and operational risk. Together, Switzerland and Canada signal a broader global shift: stablecoins are now being treated not as speculative crypto assets, but as core financial infrastructure requiring dedicated, high-trust regulatory regimes.

Disclaimer: this newsletter was put together for informational purposes only based on our review and analysis. This should not be construed as a solicitation, offer, or recommendation to acquire or dispose of any investment or engage in any transaction.

Share this post